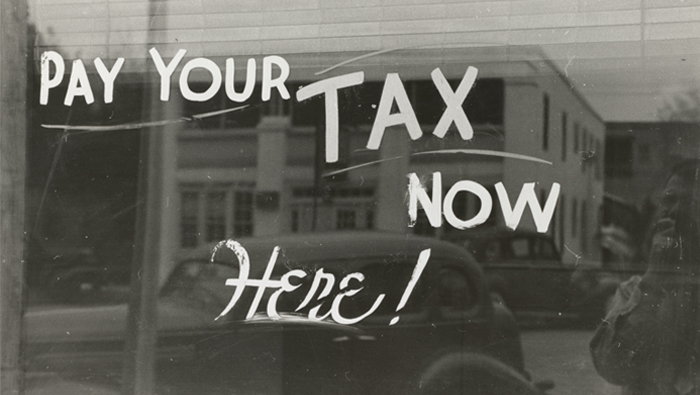

Should you pay council tax on student accommodation?

We know that council tax forms, websites, and helplines can be daunting and sometimes quite confusing, so you might not be clear on student accommodation and council tax rules. However, to make the process a little easier to understand, we have put together a list of the most common scenarios from students’ feedback, which hopefully help make council tax for your student house clearer. We’ll also guide you towards the online tools and resources that can help you manage your finances and figure out which bills you have to pay as a student and which you don’t.

Student Accommodation and Council Tax

Council tax is a tax on households by local authorities in Britain based on the estimated value of a property and the number of people living in it. The tax helps fund local services, including education, fire and police services.

As a university student, you don’t have to pay council tax for student accommodation. All university students are eligible to be exempt from paying council tax if the property they live in is occupied entirely by full-time university students. If you do get sent a bill, you can apply for an exemption.

If some of your housemates are not full-time students, then you’ll still get a council tax bill, but your household may be able to get a discount.

What if I don’t know which local council my property belongs to?

There’s no need to stress if you’ve moved to a new city and you have no idea who your local council is. Use the government’s online tool to find your local council using your postcode or address. It will then give you a link to that local council’s website so you can look through the services available or find contact information.

Do I Qualify a Full-Time Student?

To be considered a full-time student, you need to be on a course that meets the following requirements:

- the course lasts at least one calendar or academic year, or at least 24 weeks out of the year

- the course normally involves at least 21 hours of study, tuition or work experience per week during term time

Proving full-time student eligibility

Your local council will likely ask for proof that you are a full-time student when you apply for an exemption to council tax for student accommodation. You can ask your university for a certificate, which they must provide (unless more than a year has passed since your course has finished).

Do I Need to Pay Council Tax on My Student Accommodation?

Postgraduate students

The process and exemptions to council tax for student accommodation for postgraduates are the same as undergraduates. The only thing that changes is that you will have to pay during the summer months at the end of your final year as an undergraduate – even if you are going into postgraduate study right after.

This is because there will be a gap before you are officially registered and start your new course, and for those few months, you won’t technically be considered a student anymore. Frustrating, but important to know!

International students

The same rules on student accommodation and council tax that apply to UK students apply to international students, too. The only exception to this is if you are a student living with a non-student spouse or civil partner and are one of the following:

- an EEA or Swiss national, or the family member of an EEA or Swiss national, who is exercising a right of free movement in the UK

- a British citizen

- settled in the UK (with indefinite leave to enter or remain)

Houses in Multiple Occupation (HMO)

If you’re living in what is known as an HMO, this means you are living in a residence with three or more households (which can mean individuals) who share facilities; that is to say, almost every student accommodation.

However, if you’re living in an HMO and you’re one of the only full-time students, the council tax for your student accommodation is a little more tricky. You will still receive a bill, but you are likely to be eligible for a discount, or you may be eligible to be entirely exempt.

This is dependent on a few factors, including how many residents live at the property who are not full-time students. Generally, the more housemates you have who are not full-time students, the more likely it is that they will foot the entire council tax bill, with you (as a full-time student) remaining exempt.

Other factors that might affect your exemption

- Student holidays and non-term time

The exemption from council tax for your student accommodation kicks in on the day your course begins and will continue until the day you finish your course (this is the final day of your final term, rather than the day you graduate). This includes when you are on holiday – such as the summer break – and not at university studying.

So, your summer holidays are covered, but you should double-check when your final year officially ends to avoid being caught out.

- Taking some time out

There are some instances where you may have to take some time out from your full-time course; this could be because of your health or family issues, for example. This could mean suspending your studies for a little while.

If you suspend your course but are still registered because you will be returning at a later date, you should still be regarded as a student for council tax purposes.

Applying for a Council Tax Exemption

This is where things can get a bit complicated, as this all depends on how your local council operates. Some councils will ask you to call them and give your details so they can arrange an exemption from council tax for your student accommodation whilst you are still on the phone.

In other cases, you may have to fill out a ‘certificate of student status’, which you can pick up from your university admissions office and then post to your council.

Some universities offer online systems which allow you to request a letter with the appropriate information to send to the council on your behalf.

Student Accommodation Council Tax Resources

Everyone’s situation is a little different, and in general, it’s better to be on the safe side. If you have any doubts or questions about whether you should be paying council tax for your student house, try to speak to one of these services:

- Your local council

- Your university or Student Union’s advice service, which will have a host of experience and local resources to help you

- Citizens Advice Bureau, available at bureaus in person, online or over their national phone line.

As a student, you likely have a lot of things on your mind. Luckily, when it comes to council tax, student accommodation is nice and easy when you understand the process or know where to go to find information. For more advice and guidance on student accommodation, including the different types of accommodation and when you should be applying, check out our blog.